Financial Advisor vs Financial Planner

Making educated judgments about your financial future requires knowing the distinctions between Financial Advisors and Financial Planners whether you’re based in the USA or Asia, especially India. Although these names are sometimes used synonymously, they refer to various professions with unique roles, services, and regulatory frameworks. Your financial objectives will determine which expert is best for you, whether you need assistance with investment management or creating a thorough long-term financial strategy

This article will discuss the following points:

.The main distinctions between financial planners and advisors in the United States and India.

.The services they provide and their prices.

.Certifications and where to go for reliable experts.

.The procedures for becoming a planner or financial advisor in various areas.

Knowing these components will help you make more informed decisions regarding managing your finances, no matter where you live.

Defining Financial Advisors and Financial Planners

USA:

Wealth management services, tax planning, and investment management are all provided by Financial Advisors in the USA. Depending on their function, they are often governed by either the Financial Industry Regulatory Authority (FINRA) or the Securities and Exchange Commission (SEC).Common certifications include CFA (Chartered Financial Analyst) and passing the Series 65 Exam.

Financial Planners in the USA provide a more comprehensive strategy, addressing debt management, estate planning, and long-term retirement options. Usually, they are designated as Certified Financial Planner (CFP) and are bound by fiduciary standards, which means they have to behave in their clients’ best interests.

India:

Financial Advisors work with local investment products including mutual funds, bonds, and government schemes but also offer wealth management and tax planning services.SEBI (Securities and Exchange Board of India) oversees them, and they have to obtain the Investment Adviser (IA) Certification.Commissions are more typical in India than in the USA when it comes to marketing financial products.

Financial Planners in India provide complete planning services, including guidance on insurance, retirement, and education savings. Numerous people possess the CFP credential and have been accredited by the Financial Planning Standards Board (FPSB India). Additionally, some financial advisors need to obtain qualifications from the National Institute of Securities Markets (NISM).

Services Offered by Financial Planners and Financial Advisors

Services offered by Financial Planner

1.Retirement Planning

USA:One of the primary services offered by financial planners is retirement planning, which involves designing a path to guarantee you have sufficient funds when you retire. Based on anticipated expenses and lifestyle goals, financial planners assist clients in estimating their future financial needs. They recommend tax-advantaged retirement savings accounts, such as Roth IRAs,401(k) plans, and others.

Example:As clients get closer to retirement, a financial planner might advise switching investments from riskier assets (like stocks) to safer ones (like bonds).

India:Retirement planning is as important in India.Government-backed programs like the National Pension Scheme (NPS) and the Employees’ Provident Fund (EPF), which are intended to offer a consistent income after retirement, are frequently suggested by financial advisors. Additionally, they offer guidance on tax-saving schemes under Section 80C of the Income Tax Act.

Example:To create a tax-efficient retirement corpus, planners in India may suggest utilizing Public Provident Fund (PPF) or NPS.

Why It’s Important:Retirement planning protects customers from the risk of outliving their savings and guarantees financial independence in old age. Appropriate retirement planning helps prevent reliance on family members or social security systems, both in the USA and India.

2.Budgeting and Debt Management

USA:By evaluating income, expenses, and savings, financial planners in the USA assist clients in developing sensible budgets. They provide advice on how to handle debts such as student loans, mortgages, and credit card debt, frequently endorsing tactics like the “debt avalanche”and “debt snowball”techniques.

Example:A planner might advise combining high-interest credit card debt into a low-interest personal loan if a client is having trouble paying off their debt

India:Financial Planners also provide debt management and reduction solutions in India, where credit card debt, home loans, and personal loans are common financial features. They might advise setting high-interest debts as a priority and paying off balances gradually using savings or government programs.

Example:Planners may suggest to customers to use fixed deposits to obtain lower-interest loan alternatives or to pay off personal loans first.

Why It’s Important: The cornerstones of sound financial management are debt management and budgeting. While budgeting makes sure that financial goals, like saving for retirement or school, stay on track, proper debt management helps people avoid paying excessive interest and minimizes financial stress.

3.Education Planning

USA:Using tax-advantaged accounts like 529 plans, financial planners help families in the USA prepare for their children’s education. Families can take advantage of tax-free investment growth while saving for college with these options. Other options to save for education, such as UGMA/UTMA accounts or Coverdell Education Savings Accounts (ESA), are also recommended by planners.

Example:To fully benefit from compound growth, a planner would advise launching a 529 plan when the child is still young.

India:With the escalating costs of higher education both domestically and internationally, education planning is a major issue for Indian households. Planners frequently suggest mutual funds or financial instruments such as the Sukanya Samriddhi Yojana (SSY)for girls’ education to create an education corpus.

Example:To build money for future educational expenses, planners in India may advise launching “Systematic Investment Plan (SIP)” in equities mutual fund.

Why It’s Important:Planning for their children’s education guarantees that parents can support them without jeopardizing their own financial stability, Due to the escalating expenses of education in both regions, early preparation is essential to minimize the impact of significant lump sum payments or student loan debt.

4.Risk Management and Insurance

USA:In the USA, financial planners frequently evaluate the risks of their clients and suggest suitable insurance plans, such as long-term care insurance,health insurance, disability insurance, and life insurance. They make sure their customers are sufficiently shielded from unforeseen circumstances that can sabotage their financial objectives.

Example:A planner may recommend term life insurance as an affordable means of supporting a family in the case of an early death.

India:Because medical costs are so high, risk management in India involves not only life insurance but also health insurance and critical illness coverage. Because term insurance offers greater coverage at a lesser cost than standard endowment policies, financial advisors frequently suggest it over the latter.

Example: To guarantee sufficient medical coverage, a planner might suggest to a client purchasing a comprehensive health insurance policy and adding a critical illness rider.

Why It’s Important:Unexpected catastrophes like illness, incapacity, or death can have disastrous financial effects, which makes risk management essential. Having the right insurance guarantees the safety of your assets and family.

5.Tax Optimization

USA:To reduce obligations, financial planners provide tax planning assistance in the USA. This includes organizing charitable donations for tax deductions, contributing to tax-advantaged accounts like Roth IRAs, and offering advice on tax-loss harvesting. Planners for high net worth persons might recommend trusts as a way to lower estate taxes.

Example: To lower future tax obligations, a planner might suggest converting a traditional IRA to a Roth IRA during a low-income year.

India: Utilizing deductions under 80C, 80D, and 24(b) of the Income Tax Act is a key component of tax optimization in India. Planners assist customers in maximizing their tax-saving options, such as life insurance premiums,ELSS (Equity-Linked Savings Scheme), and PPF investments.

Example:To lower taxable income and increase wealth at the same time, a financial planner would advise investing the maximum amount permitted under Section 80C.

Why It’s Important: Tax planning that maximizes income retention allows people to save and invest more of their income. Appropriate tax planning can result in substantial wealth gain over time.

Services Offered by Financial Advisors

Financial advisors primarily focus on managing investments and specific financial tasks. Their services are ideal for individuals or businesses seeking growth through optimized asset allocation, tax strategies, and estate planning. Here’s a detailed breakdown of the key services financial advisors offer:

1.Investment Management

USA:In the USA, financial advisors’ primary service is investment management. They assist customers in creating and maintaining portfolios made up of securities such as stocks, bonds, mutual funds, and others. Advisors evaluate your schedule, financial goals, and risk tolerance before recommending an appropriate asset allocation. In addition, they regularly rebalance the portfolio in response to shifts in your financial circumstances and market performance.

Example:A financial advisor might recommend a portfolio heavily weighted toward stocks for a younger client, then shift toward bonds as the client nears retirement to reduce risk.

India:Similar services are offered by financial advisors in India, although they frequently focus on tax-saving options like Public Provident Fund (PPF),Unit Linked Insurance Plans (ULIPs) and Equity Linked Savings Schemes (ELSS). Advisors suggest Indian market-specific strategies that frequently strike a balance between high-risk and low-risk options backed by the government.

Example:A financial adviser investing in mutual funds for long-term growth might allocate a portion of a client’s portfolio to PPF for steady, tax-saving returns.

Why It’s Important: Effective investment management is essential to building and safeguarding wealth. Advisors ensures that your investments match your objectives, market conditions, and risk tolerance. They also make adjustments to plans to enhance returns over time.

2.Tax Planning

USA:Financial advisors provide tax planning techniques in the USA with the goal of lowering taxable income and maximizing deductions. Advice on tax-efficient investing techniques, such Roth IRAs,401(k) contributions,and tax-loss harvesting to balance gains with losses, is part of this. Additionally, they assist wealthy customers in structuring their assets to save estate taxes.

Example:To take advantage of future tax-free growth, an adviser may advise a client to max out contributions to a Roth IRA in years when their income is lower.

India:Because of the intricate web of tax exemptions, financial advisors in India place a lot of emphasis on tax preparation. Advisors advise customers on how to employ tax-saving investments to reduce liability and suggest Section 80C investments,such as National Savings Certificates (NSC) and ELSS.

Example:In order to obtain tax advantages and pursue better returns than conventional fixed-income choices, advisors frequently advise customers to invest in ELSS funds.

Why It’s Important:By lawfully reducing tax payments, tax planning assists customers in having more money available for investments or other financial objectives. Particularly over time, strategic tax management can result in large savings.

3.Estate Planning

USA:In the USA, financial advisers frequently assist customers with estate planning, which entails arranging a client’s assets to guarantee a seamless transfer of wealth upon death. This service can include naming beneficiaries for retirement funds and insurance policies, creating trusts, making wills, and avoiding estate taxes.

Example:To avoid probate and streamline the transfer of assets to heirs, a financial advisor might advise creating a revocable living trust.

India:Although less widespread, estate planning is becoming more popular as income rises in India. Financial advisors provide strategies for wealth transfer through trusts and nominee designations on bank accounts, real estate, and other assets, and assist clients in drafting wills and managing inheritance laws.

Example:To prevent disagreements among heirs, advisors may advise creating a will that specifies the division of assets in detail.

Why It’s Important:Estate planning is necessary to guarantee that your wealth is dispersed in accordance with your intentions and to minimize any legal issues that may arise for your beneficiaries. Tax liabilities can be reduced and a seamless asset transfer can be guaranteed with careful planning.

4.Risk Management and Insurance

USA:insurance planning is a common service provided by financial advisors in the USA. After evaluating a client’s needs, they suggest suitable insurance, such as long-term care insurance, disability insurance and life insurance. Advisors assist clients in selecting the appropriate insurance type and coverage level to guard against unanticipated hazards.

Example:To provide financial stability in the event of the client’s untimely death, an adviser may suggest a term life insurance policy to a customer who has dependents.

India:Financial advisors also offer insurance-related guidance in India, with a focus on critical illness plans, life insurance and health insurance. They assist customers in comprehending the range of available products and guarantee sufficient coverage to safeguard the financial future of their family.

Example: Rather than endowment policies, which frequently give less coverage for more premiums, an advisor can suggest a term insurance plan.

Why It’s Important:An essential component of financial planning is risk management via insurance.It guards against financial disaster for clients and their families in the event of unanticipated circumstances like accidents, disease, or death.

5.Planning for Retirement

USA:Financial advisers are vital in ensuring that clients accumulate enough retirement savings, even if they are more often linked with financial planners when it comes to retirement planning. Advisors assist clients in maximizing their contributions to Roth IRAs,401(k)s and other tax-favored retirement plans.

Example:Depending on the client’s proximity to retirement, a financial advisor may recommend a combination of stocks and bonds in a 401(k) plan to balance growth and risk.

India:Using programs like the National Pension Scheme (NPS) and the Employee Provident Fund (EPF), financial advisors in India help customers accumulate retirement savings. They offer guidance on the right amount of contributions to make and help clients understand the intricacies of early withdrawals and tax advantages.

Example:For a more well-rounded retirement plan, advisors may suggest combining contributions to NPS with tax-saving mutual funds.

Why It’s Important:Having adequate savings to support a client’s lifestyle in retirement is ensured by proper retirement planning. Financial advisors oversee assets and improve savings strategies in order to guarantee a stable income after retirement.

Costs and Fee Structures

USA

Financial Advisors often charge a percentage of assets under management (AUM),which varies between 0.5% and 2% yearly. In addition, some might get commissions from the sale of financial goods or charge an hourly fee for specialized advice.

Financial Planners:They typically bill a hourly rate or a flat fee.For full preparation, these expenses might vary from $2,000 to $7,500 annually, or $150 to $400 per hour.

India:

Financial advisers:A large number of financial advisers in India continue to work under a commission-based business model, taking fees from the mutual funds or insurance products they suggest. But fee-only advisors are becoming more and more popular; their hourly or fixed fees usually range from INR 2,000 to INR 10,000 for consultations.

Financial Planners:Depending on the intricacy of the financial plan, financial planners in India usually charge a flat fee or a annual retainer.Comprehensive financial planning can cost anywhere from INR 25,000 to INR 1 lakh per year.

Key Certifications and Qualifications

USA:

Financial Advisors:CFA (Chartered Financial Analyst) and passing the Series 65 exam are common certifications for financial advisors who offer investment advice. A Certified Investment Management Analyst (CIMA) credential may also be held by certain advisors.

Financial Planners: The most coveted credential for financial planners in the United States is the Certified Financial Planner (CFP) title. It calls for passing difficult tests, receiving ethics instruction, and continuing education.

India:

Financial Advisors:To work as a financial advisor in India, a candidate must pass the SEBI Investment Adviser exam. They may also be certified as CFA (India). In order to distribute mutual funds, many advisers additionally obtain the NISM(National Institute of Securities Market) certifications.

Financial Planners:The highest qualification for financial planners is the CFP (India) designation, given by FPSB India.Certified Personal Financial Advisor (CPFA) designation is also held by certain planners.

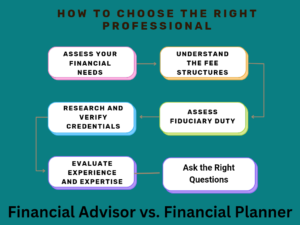

How to Choose the Right Professional: Financial Advisor vs Financial Planner

1.Assess Your Financial Needs

Financial Advisor: A financial advisor can be your best choice if investment management, portfolio optimization, or short-term financial decisions like wealth growth or tax planning are your main concerns. Advisors are experts in customizing investment plans, assisting with risk management, and maximizing asset allocation. They are perfect for people who want to lower their tax obligations or increase capital.

Example:To actively manage and rebalance their investments, a high-net-worth individual with a diversified portfolio might need the assistance of a financial advisor.

Financial Planner:A financial planner is a better option if you require more thorough, long-term advice related to retirement planning, debt management, or developing a complete financial roadmap. Planners are well-suited for individuals trying to attain several financial goals, like saving for a child’s education, retirement, and managing insurance needs.

Example:A family with children might seek a financial planner to develop a strategy for saving for college while ensuring they are on track for retirement and maintaining the right insurance coverage.

2.Understand the Fee Structures

Financial Advisors:The percentage of assets under management (AUM) is typically used as the basis for financial adviser fees. This usually amounts to 0.5% to 2% per year. On a commission-based basis, advisors receive compensation for the purchase or sale of financial instruments such as mutual funds, insurance policies, and stocks. Advisors may occasionally bill hourly or fixed fees for particular services.

Example:An advisor charging a 1% fee to manage a $500,000 portfolio would get $5,000 a year.

Financial Planners:Financial planners normally operate on a flat fee or hourly basis,particularly for building comprehensive financial plans. Planners sometimes provide retainer models, in which you pay a yearly or monthly fee for continuing guidance. Retainers or flat payments are becoming more popular in India,to avoid potential conflicts of interest that arise with commission-based models.

Example:A financial planner might charge a flat fee of INR 50,000 annually in India, or a one-time fee of $3,000 in the USA for a detailed financial plan.

3.Research and Verify Credentials

USA:It’s crucial to confirm that the professional has the appropriate certificates in the USA. To offer investment advice, financial advisers should ideally possess credentials such as Chartered Financial Analyst (CFA) or have completed the Series 65 exam. The Certified Financial Planner (CFP)accreditation is a must for financial planners as it guarantees their adherence to strict guidelines in the field.

How to Verify:In the USA, the CFP Board and FINRA (Financial Industry Regulatory Authority) are two regulatory organizations where you may confirm a financial professional’s qualifications.

India:Financial planners and advisers in India ought to possess the necessary credentials, like the SEBI Registered Investment Adviser (RIA) or the CFP (Certified Financial Planner) designation. These certifications guarantee that the planner or advisor adheres to ethical guidelines and operates with fiduciary responsibility, meaning they must act in your best interest.

How to Verify:Use SEBI’s database or the FPSB India website to confirm if a professional is certified and in good standing.

4.Assess Fiduciary Duty

Whether or not a financial counselor or planner is bound by a fiduciary duty is a significant distinction between many of them. It is legally required of fiduciary professionals to behave in your best interest.

Financial Advisors:Financial advisors are not always fiduciaries. Commission-based advisors may be in conflict of interest if they offer specific financial products and receive larger fees.

Financial Planner: A large number of financial planners are fiduciaries, particularly those who hold the CFP credential. This guarantees that their counsel is impartial and constantly serves the interests of the client.

Why It Matters:There is less chance of conflicts of interest when working with a fiduciary. Make sure your planner or advisor follows a fiduciary standard so you may feel comfortable knowing they are maximizing your financial well-being rather than just selling products for a commission.

5.Evaluate Experience and Expertise

USA:It’s critical to take into account a financial professional’s area of expertise when selecting one. For instance, a financial advisor with a CFA designation and prior portfolio management experience would be perfect if your area of interest is investment management. Seek out an experienced CFP who specializes in estate planning, retirement planning, and tax optimization if you require a comprehensive financial strategy.

India:Seek specialists with knowledge of intricate tax regulations, investment plans, and government-sponsored initiatives such as NPS,EPF and ELSS. Financial advisors who are familiar with the estate planning laws and tax-saving techniques used in India can offer more specialized guidance.

6. Ask the Right Questions

Before making a decision, conduct an interview or consultation with the financial professional. Here are some key questions to ask:

1.What services do you offer?

.Do they offer full planning, or are they just focused on investments?

2.What credentials do you possess?

.Verify whether they possess pertinent credentials such as SEBI IA, CFP, or CFA.

3.Are you bound to behave in our best interest?

.Verify if they are a fiduciary.

4.What is your charge schedule?

.Know whether they operate on an AUM, commission, or flat fee basis.

5.What is your planning methodology or investing philosophy?

.Verify that their approach fits your objectives and risk tolerance).

Why It Is Important:By posing these queries, you may make sure the adviser or planner’s methods are in line with your own by getting a better understanding of how they work.

Choosing the right financial professional requires a thorough evaluation of your financial needs, the professional’s credentials, their fee structure, and whether they operate under a fiduciary duty. In both the USA and India, verifying certifications and understanding fee models are key to finding a trusted advisor or planner who will act in your best interests. Taking the time to assess their expertise, experience, and approach will help ensure that you receive the advice and services best suited to achieving your financial goals.

Conclusion: Selecting the Appropriate Financial Professional

Your unique financial needs will determine which financial advisor or planner is best for you. A financial advisor is the best choice for individuals who want to increase their wealth because they specialize in estate preparation, tax planning, and investment management. Financial planners, on the other hand, use a more comprehensive and long-term strategy, including assistance with risk management, budgeting, retirement, and school funding.

Financial planners frequently employ tax-loss harvesting, Roth IRAs, and 401(k)s in the United States. In India, they advocate for government-sponsored programs such as NPS and PPF. Your interests are given first priority by trained professionals, such as CFPs and CFAs in the USA or SEBI-registered advisers in India.

The prices for these services differ. Financial advisors may bill by the hour, by the flat fee, or by the percentage of assets. Retainers or fixed payments are typical in India. Selecting the ideal expert for your financial objectives is made easier when you are aware of these pricing schedules. A financial advisor could be a good fit for you if investing is your only area of interest. However, a financial planner is a superior choice if you require assistance with several financial sectors. In any scenario, the secret to safeguarding your financial future is making sure they have the appropriate credentials and reliability.

FAQ

1.What is the primary distinction between a financial planner and an advisor?

Managing investments and providing guidance on particular financial products are the usual areas of focus for a financial advisor. A financial planner, on the other hand, offers complete financial planning, which covers risk management, tax planning, retirement planning, and budgeting.

2.Can financial planners manage investments like financial advisors do?

Yes, many financial planners also offer investment management services, but they typically do so within the context of a broader financial plan that includes other goals, such as retirement or education planning. On the other hand, financial advisors usually specialize only in managing investments and maximizing returns.

3.Is there a fiduciary obligation for financial advisors and planners?

Not all financial advisors are fiduciaries, especially those who work on a commission-based model. They may have a conflict of interest when recommending financial products.

Financial planners, especially those with a CFP certification, are typically fiduciaries, meaning they are legally required to act in the best interest of their clients.

4.How do I find a trustworthy financial advisor or planner?

USA: Look for certifications such as CFA (Chartered Financial Analyst) for advisors and CFP (Certified Financial Planner) for planners. Verify their credentials through regulatory bodies like FINRA or the CFP Board.

India: Verify whether the advisor or planner is registered with SEBI or holds a CFP certification through FPSB India. Check their background and credentials to ensure they are reputable and trustworthy.

5.Are financial advisors and financial planners regulated differently in the USA and India?

USA: Financial advisors are typically regulated by FINRA and the SEC (Securities and Exchange Commission). Financial planners with a CFP certification must adhere to strict fiduciary standards, meaning they must act in their clients’ best interests.

India: Financial advisors and planners are regulated by SEBI (Securities and Exchange Board of India). Planners who hold CFP certification from FPSB India are also required to adhere to fiduciary standards.

6.How do financial advisors and financial planners charge for their services?

Financial Advisors: Typically charge based on a percentage of assets under management (AUM) (usually 0.5% to 2%), commission on financial products, or an hourly rate.

Financial Planners: Often charge flat fees, hourly rates, or annual retainers for comprehensive planning. In India, they may also charge a flat annual fee or a monthly retainer for ongoing services.