Creating a personal budget may seem like a difficult task, especially if you’re new to managing your finances. However, think of it as mapping out a treasure hunt where the treasure is your financial freedom! In this post, we’ll walk you through what a budget is, why you need one, and how to Create Your Personal Budget in a way that’s both practical and enjoyable and what resources are available to learn budgeting. Whether your goal is to save for a dream vacation or simply trying to avoid those dreaded end-of-month money woes, this post will provide you with the practical tips and tools you need to succeed

What Is a Budget?

Before you jump into the world of spreadsheets and expense trackers, it’s important to understand exactly what a budget is.

Definition: A budget is a plan that helps you decide how to allocate your income toward expenses, savings, and debt repayment. Consider it your financial blueprint.

Important Elements:

1.Income: The money you make from investments, side projects, or your employment.

2.Fixed Expenses: Regular monthly bills like utilities, insurance, and rent.

3.Variable Expenses: Monthly expenses that vary such as groceries, entertainment, and eating out.

4.Periodic Expenses: Occasional costs such as yearly subscriptions, presents for the holidays, or auto repairs.

Understanding these basics is the first step to taking control of your money-and trust us, it’s far less intimidating than it sounds!

Why Create A Personal Budget?

Benefits of Having a Personal Budget

You might wonder, “Why should I bother with a budget?” The answer is simple: a budget is your ticket to financial empowerment. Beyond simply keeping tabs on your expenses, a personal budget has the power to drastically alter your financial situation. Here’s why budgeting matters:

1.Gain Financial Clarity: You can make better decisions and prevent stress of unexpected shortfalls, when you know exactly where your money is going.

2.Better Savings: You may put money aside for future investments, emergencies, or that much-needed vacation when you have a budget. It’s like paying yourself first!

3.Improved Debt Management: You can make better plans to pay off debt and prevent overspending when you know where your money is going.

4.Lessen Financial Stress: Budgeting removes the guesswork from your spending habits. You can relax knowing that you’re in charge when you have a well-defined plan in place.

5.Reach Your Goals: Whether your goal is to pay off debt, save for a home, or build an emergency fund, a budget creates a roadmap to reach those dreams.

For more information on taking charge of your finances, read the article on “Personal Finance for Beginners:Simple Steps to Manage Money and Build wealth” for additional insights on taking control of your finances.

Remember, budgeting isn’t about restricting your spending; it’s about making intentional choices that align with your goals and values.

Understanding Your Financial Situation before Creating A Personal budget

Before you start drafting your personal budget, it’s essential to get a complete picture of your financial situation. This involves a few key steps:

1.Assess Your Income

Calculate Net Income: Start by listing all sources of income—after taxes. This includes your salary, freelance earnings, or any other regular revenue.

Keep It Real: If you have irregular income, consider calculating an average over several months to get a realistic figure.

2.Track Your Expenses

Categorize Your Spending:

Fixed Expenses: These are predictable and recur every month (e.g., rent, utilities).

Variable Expenses: These can vary, like groceries or entertainment.

Periodic Expenses: Don’t forget costs that occur less frequently, like yearly subscriptions.

Practical Tip: Use a basic spreadsheet or a Personal Finance software (GoodBudget or YNAB) to track your spending for at least a month. You might be surprised by the small expenses that add up!

3.Analyze Your Spending Habits

Spotting Trends: Look for patterns in your spending. Do you usually spend too much money eating out? Or maybe you’re underestimating your utility bills?

Set Priorities: Identify which costs are necessary and which might be reduced. At this point, you can begin tailoring your budget to achieve your financial goals.

4.Setting Financial Goals

It’s time to establish your financial goals after you have a clear picture of your current financial state. Goals give your budget a purpose and a target to aim for.

A.Define Your Goals

Short-Term Goals: These could be paying off a small debt or creating an emergency fund.

Medium-Term Goals: Consider saving for a vacation, a new gadget, or even a car.

Long-Term Goals: Think about retirement savings, purchasing a home, or investing in your future.

B. Use the SMART Framework

Specific: Clearly define what you want to achieve.

Measurable: Ensure your goal has a quantifiable target.

Achievable: Set realistic goals based on your income and expenses.

Relevant: Align your goals with your overall financial priorities.

Time-bound: Set a deadline for reaching your goal.

By setting SMART goals, you’ll be able to measure your progress and stay motivated over time.

5.Building an Emergency Fund: Your Safety Net for Money

A critical element of your personal budget is an emergency fund, which guarantees that you’re ready for unforeseen circumstances such as an unexpected repair, medical emergency, or abrupt job loss. You create a financial cushion that offers stability and peace of mind by putting aside a percentage of your income. Key tips to create a robust emergency fund include:

Consistent Savings: Set aside a fixed percentage of your income each month.

Target Amount: Aim for three to six months’ worth of expenses.

Accessible Account: Use a high-yield savings account for quick access.

Priority Contribution: Treat your emergency fund as a non-negotiable expense.

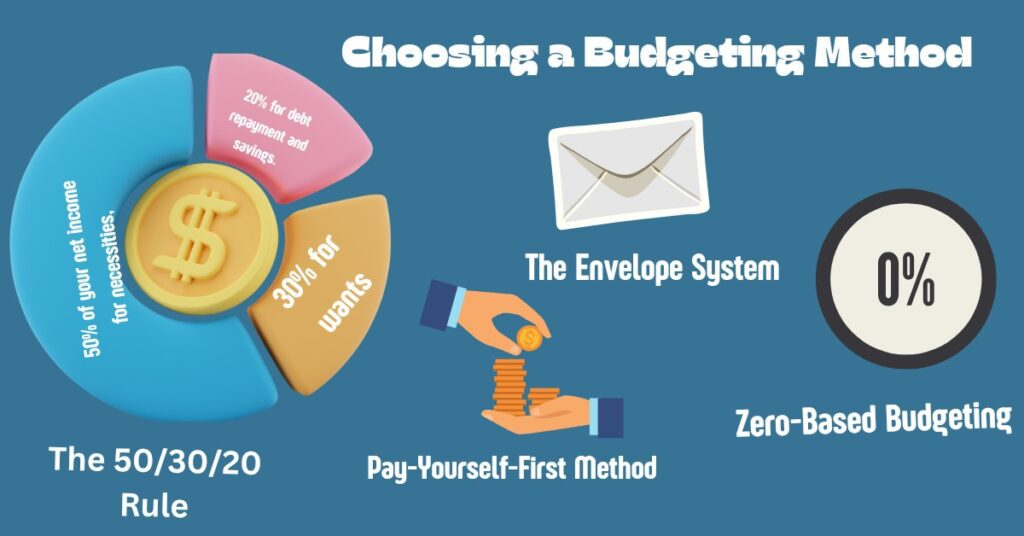

6. Choosing a Budgeting Method

There is no one-size-fits-all method for creating a personal budget. Your lifestyle, level of income stability, and financial objectives will determine the best approach. These are a few widely used techniques:

A. The 50/30/20 Rule

How it works: Set aside 50% of your net income for necessities, 30% for wants, and 20% for debt repayment and savings.

Who It’s For: Perfect for beginners seeking an easy-to-understand structure.

B. Zero-Based Budgeting

How It works: Every dollar of your income has a purpose- from bills to savings- until there are no dollars left over.

Benefits: This approach guarantees that every penny is contributing to your financial goals and promotes mindful spending.

C. The Envelope System

Withdraw your budgeted amount in cash and put it in envelopes labeled for different spending categories.

Benefits: It’s a tactile, visual way to manage spending and can help curb overspending.

D. Pay-Yourself-First Method

How It Works: Prioritize saving by automatically transferring a set amount into your savings account before paying any bills.

Benefits: This method builds savings effortlessly and ensures you’re consistently working toward your future goals.

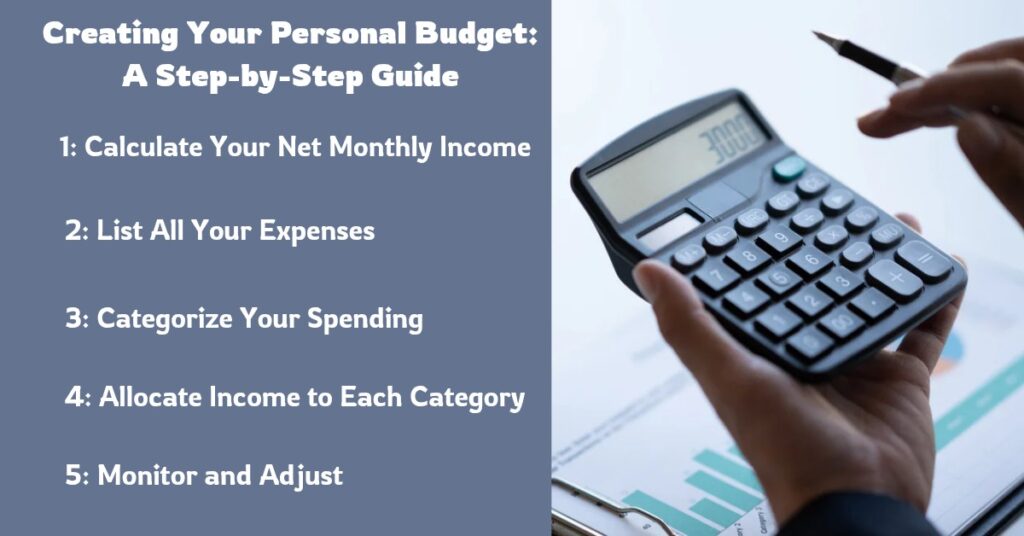

Creating Your Personal Budget: A Step-by-Step Guide

Let’s put it all together! Here’s a step-by-step process to create your personal budget:

Step 1: Calculate Your Net Monthly Income

Gather Your Paychecks: List all sources of income after taxes.

Practical Tip: If your income varies, consider using an average over several months for a more stable base.

Step 2: List All Your Expenses

Document Every Expense: Write down fixed, variable, and periodic costs. Don’t forget to include smaller expenses that might slip through the cracks!

Tools: Use budgeting apps or simple Templates, spreadsheets to keep track.

A. Microsoft Personal Budgeting Templates

budgetinghttps://create.microsoft.com/en-us/templates/personal-budgeting

B. ExcelX Budget Templates

https://excelx.com/template/budget/

C. 101 Planners’ Budget Sheet Template

https://www.101planners.com/budget-sheet-template/

Step 3: Categorize Your Spending

Create Budget Categories: Organize your expenses into groups like “Housing,” “Food,” “Transportation,” “Entertainment,” and “Savings.”

Practical Example: If you spend a lot on coffee, create a small category to track it separately. You might find opportunities to save!

Step 4: Allocate Income to Each Category

Choose a Budgeting Method:

Whether it’s the 50/30/20 rule or zero-based budgeting, assign your income to each category accordingly.

Percentage Guidelines: Use percentage allocations as a guide, but feel free to adjust based on your personal priorities.

Step 5: Monitor and Adjust

Track Your Progress: Regularly update your budget to see how well you’re sticking to it.

Be Flexible: Life changes—so should your budget. Review it monthly and adjust if necessary.

Downloadable Checklists

Download our Free Money Saving Checklist to help you:

Track daily and monthly spending.

Download Your Free Checklist of completed tasks.

Common Budgeting Mistakes to Avoid

If you’re not careful, even the best-laid plans can go wrong. Here are some typical pitfalls while creating a personal budget and strategies to avoid them:

1. Unrealistic Expectations: Excessively rigid boundaries can be demoralizing. Set achievable targets. and be truthful about your spending patterns.

2. Inconsistent Tracking: Inaccurate budgeting may result from a failure to routinely record your expenses. Develop the habit of tracking and schedule weekly time to update your records.

3. Ignoring Periodic needs: If you don’t budget for annual or seasonal needs, such auto repairs or holiday presents, they might cause financial disruption.

4. Lack of Flexibility: If your financial circumstances change, a strict budget can easily become outdated. Be prepared to modify your allotments as necessary.

5. Ignoring Savings: It’s tempting to focus on day-to-day spending and forget to save. Always “pay yourself first” to build financial security.

Practical Tip: Keep a “buffer” category for unexpected expenses. This not only protects your budget but also reduces stress when surprises arise.

Implementing and Sticking to Your Personal Budget

Creating a personal budget is one thing–but sticking to it is where the real challenge lies. Here are some strategies to help you stay on track:

1. Frequent Evaluations: Establish a weekly or monthly routine for reviewing your spending and budget. This helps you catch overspending early.

2. Make Use of Technology: To monitor your finances, use online tools or download budgeting applications. You may maintain discipline by using the insights and notifications that many of these apps provide.

3. Automate whenever possible: Set up automatic transfers for savings and bill payments. Automation helps you stick to your savings goals and lowers the chance of skipping a payment.

4.Celebrate Milestones: Reward yourself when you hit financial targets–whether it’s paying off a debt or saving a specific amount. Celebrations (even small ones) can boost motivation.

Explore our guide on “Top Budgeting Apps for Young Adults” to find tools that can simplify your journey.

Utilizing Budgeting Tools and Resources To Create A Personal Budget

Don’t go at it alone—there are plenty of resources available to help you master your personal finance and create your personal budget.

1.Budgeting Apps:

Apps like Honeydue, You Need a Budget (YNAB), and PocketGuard can simplify tracking your income and expenses.

A. Cleo

An AI-powered chatbot that provides personalized budgeting advice and real-time financial insights.

https://meetcleo.com

B. Monarch Money

A comprehensive financial management tool using AI to help you create budgets, track expenses, and set financial goals.

https://monarchmoney.com

C. PocketGuard

An app that leverages AI to simplify your budgeting process, showing your available spending after accounting for bills and savings.

https://pocketguard.com

D. You Need A Budget (YNAB)

A popular budgeting tool that incorporates modern techniques and AI insights to help you manage your money effectively.

https://www.youneedabudget.com

E. Wally

An AI-driven expense tracker that offers detailed insights into your spending habits and helps you set and achieve savings goals.

https://wally.me

2.Spreadsheets and Templates:

If you prefer a more hands-on approach, consider using customizable spreadsheets. Many free templates are available online to get you started and some of them are mentioned above.

3.Books

Educate yourself further with books on personal finance. The more you know, the better equipped you’ll be to manage your money.

A. Rich Dad Poor Dad by Robert Kiyosaki: Learn the difference between assets and liabilities and how to make money work for you.

B. Personal Finance for Dummies by Eric Tyson: A beginner-friendly guide covering everything from budgeting to retirement planning.

4.Online Courses:

Enroll in an online budgeting course. Some of the important courses are:

A. Budgeting Essentials and Development

Offered by Coursera, this course provides a comprehensive understanding of budgeting processes, integrating strategic guidelines, and developing logical budget planning sequences.

https://www.coursera.org/learn/budgeting-essentials-development

B. Budget Analysis and Forecasting Online Training

ACTE offers this course focusing on the entire budgeting process, including creating a disciplined budgeting culture, building budgets, analyzing results, and improving organizational performance.

https://www.acte.in/budget-analysis-and-forecasting-online-training

5.Websites:

A. Class Central

A platform that aggregates free and paid online courses from top universities, including subjects like budgeting, personal finance, and accounting.

https://www.classcentral.com/subject/budgeting

B. Venture Lessons

Provides a curated list of budgeting courses, classes, and training programs with certificates, helping learners find suitable courses based on various factors.

https://www.venturelessons.com/best-budgeting-courses/

6.Community Forums:

Join personal finance and budgeting communities online on Reddit and Quora. Sharing tips and success stories can be both motivating and educational.

A. Reddit

https://www.reddit.com/r/personalfinance/

https://www.reddit.com/r/Budgeting/

B. Quora

https://www.quora.com/topic/Personal-Finance

https://www.quora.com/topic/Budgeting

C. Other Budgeting Communities

Goodbudget Community: https://forums.goodbudget.com/

Budgeting Talk Forum: https://budgetingtalk.com/

Discuss Personal Finance Forum: https://forums.feedspot.com/personal_finance_forums/

7. Explore the following:

For a comprehensive understanding of personal budgeting, you may also refer to the related Wikipedia article:

https://en.wikipedia.org/wiki/Personal_budget

Final Thoughts

Budgeting isn’t just about numbers–it’s about taking control of your life and making your money work for you. By understanding what a budget is, why it’s important, and how to create a personal budget effectively, you’re on your way to achieving financial freedom. Whether you’re just starting out or need to revamp your current system, these practical tips can help you build a sustainable, realistic plan that suits your unique situation.

So, what are you waiting for? Dive into your finances, set those SMART goals, and start creating your personal budget today.

Take action today:

Download a free budgeting template here.

Try budgeting apps like Pocket Guard or YNAB.

Share your budgeting experience in the comments!

Take charge of your money now, and let the journey to financial freedom begin!

FAQs

1.What is a personal budget?

A personal budget is a financial plan that tracks your income, expenses, savings, and debt. It helps you manage your money and reach your financial goals.

2. Why is budgeting important for beginners?

Budgeting provides clarity on where your money goes, reduces financial stress, and sets a clear path toward achieving your short-, medium-, and long-term goals.

3. What budgeting methods are recommended for beginners?

Popular methods include the 50/30/20 rule, zero-based budgeting, the envelope system, and the pay-yourself-first method– each offering unique benefits based on your financial situation.

4. How can I effectively track my expenses?

Use budgeting apps, spreadsheets, or online tools to record daily, weekly, and monthly expenses. Regular tracking helps identify spending habits and areas for improvement.

5.What common budgeting mistakes should I avoid?

Avoid setting unrealistic limits, inconsistent tracking, and ignoring periodic expenses. Flexibility and regular reviews are key to maintaining an effective budget.

6. How often should I review and adjust my budget?

It’s best to review your budget monthly–or even weekly–to ensure it reflects any changes in your income or expenses and remains aligned with your financial goals.

7. Can a personal budget help me save money?

Absolutely! A well-planned budget not only controls spending but also prioritizes savings, helping you build an emergency fund and work toward long-term financial freedom.