Fraudulent schemes that trick people into investing money under false pretenses and cause large financial losses are known as investment scams. It is essential to learn how to avoid investment scams, particularly because they are becoming more common in India and Globally. Scammers frequently target unsuspecting individuals with promises of large returns or secure investments in order to take advantage of emotions like fear and greed.

Scams involving investments have caused enormous financial losses on a global scale. In 2022, the FTC recorded $8.8 billion in losses, a 30% increase over the year before. Millions of people in India were impacted by scams such as the Saradha Chit Fund and the GainBitcoin scam, which caused victims to lose anything from lakhs to crores of rupees.

With the growing popularity of digital investments, scammers are increasingly targeting online platforms and social media users. This article will guide you on how to avoid investment scams by recognizing warning signs, protecting your assets, and taking action if you become a victim.

Understanding Investment Scams

What Are Investment Scams?

Fraudulent schemes that deceive victims into making investments based on false promises are known as investment scams. These frauds can pose as trustworthy companies and frequently use clever strategies to trick even seasoned investors.

Globally: By promising steady, high returns, Bernie Madoff’s Ponzi scheme duped investors out of $65 billion.

Indian Context: The Sahara group exposed people’s susceptibility to unregulated schemes by providing millions of investors with misleading profits.

Why Do Individuals Become Victims?

1.Globally: Scammers take advantage of feelings like FOMO (Fear of Missing Out) or a desire for immediate financial gain.

2.India: According to SEBI, just about 24% of people are financially literate. Additionally, because people in rural and semi-urban areas depend on unofficial money networks, scams flourish there.

Common Types of Investment Scams

1.Ponzi schemes

Funds from new investors are used to pay returns to earlier investors.When there aren’t enough new investors, the plan fails.

Global Example: Thousands were defrauded by Bernie Madoff’s scheme, which promised consistent returns.

Indian Example: By promising unreasonably large profits, the Rose Valley and Saradha chit fund frauds cheated investors out of crores.

2. Pyramid Schemes: Instead of making money by selling goods or services, participants mostly make money by recruiting others.

Global Example: In the United States, pyramid scams such as Herbalife have come under legal scrutiny.

Indian Example:As an example, MLM (Multi-Level Marketing) programs have used the promise of passive income to attract middle-class families in India.

By producing fake tokens or platforms, scammers take advantage of the excitement surrounding digital currency and crypto investment.

Global Example: Losses from the FTX crash were $8 billion.

Indian Example:The GainBitcoin scam deceived more than 8,000 people in India by promising astronomical returns on fictitious bitcoin investments.

4.Advance Fees Frauds

Scammers demand upfront payments from victims in exchange for rich possibilities, which they never provide.

Frequently distributed through phishing emails or fraudulent loan offers, these scams are prevalent both internationally and in India.

5.Affinity Frauds

The Fraud of Affinity Fraudsters take advantage of the trust that exists among particular communities, including religious or cultural groups.

Global Example: Scams that target American Christian communities.

Indian Example: When fraudulent schemes target self-help groups or religious groups in rural areas.

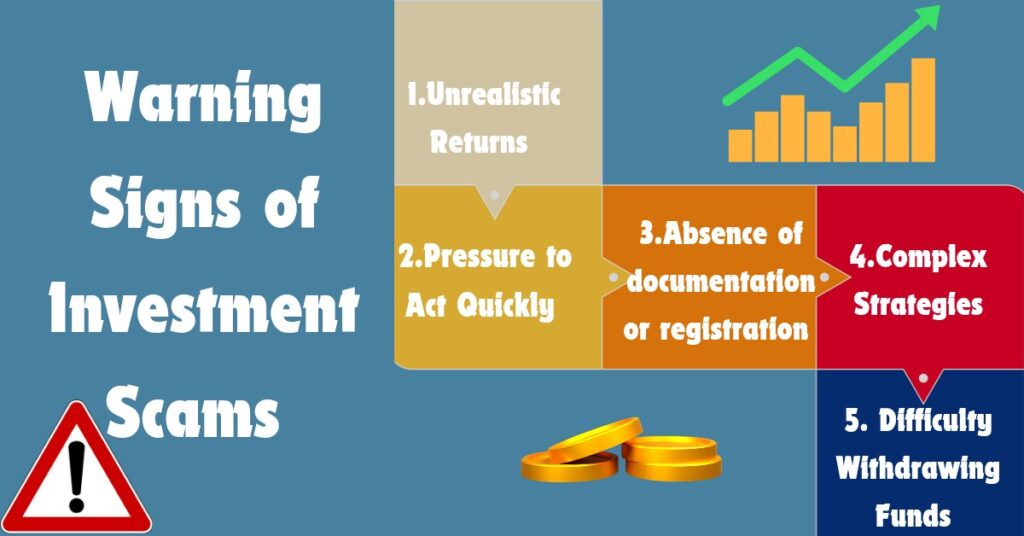

Warning Signs of Investment Scams

The first line of defense is identifying the warning signs of investment frauds. In order to entice victims, scammers frequently employ high-pressure tactics and false promises.

Common Warning Signs

1.Unrealistic Returns

Claims of huge returns that are assured, like “Double your money in three months.”

Scams such as Ponzi schemes are based on such promises all over the world.

Chit fund scams in India sometimes use such claims to entice rural investors.

2.Pressure to Act Quickly

Fraudsters demand decisions right away and make promises of time-limited deals.

Indian context: Con artists impersonating bank employees can assert that deals expire in a matter of hours.

3.Absence of documentation or registration

Organizations such as the SEC (U.S.) or SEBI (India) oversee legitimate investments.

Scams frequently lack clear legal documentation or appropriate registration.

4.Complex Strategies

To mislead victims, scammers employ technical terms or excessively complex explanations.

Example : Cryptocurrency frauds conceal fraudulent activity with technical jargon.

5.Difficulty Withdrawing Funds

Requests to withdraw money are delayed or excused by scammers, which suggests a potential fraud.

6.Social Media Red Flags

Social networking has developed into a haven for scammers:

False investment advisor profiles.

Fraudulent schemes that influencers promote.

Phishing links that lead to fraudulent sites are sent through direct messaging on WhatsApp and Telegram groups.

How to Protect Yourself from Investment Scams

Use government resources like SEC EDGAR (U.S.) or SEBI SCORES (India) to verify companies.

Verify internet reviews and grievances.

Make sure the financial advisor has certification from SEBI (India) or other regulatory bodies that are comparable worldwide.

Steer clear of unregistered platforms or people.

3.Recognize the Investment

Refrain from making an investment in something you don’t fully comprehend.

Request detailed written explanations of the return generation process.

4.Exercise Caution Online

Watch out for unsolicited social media messages or advertisements that promote “risk-free” investments.

When making investments, only use verified apps and websites.

5.Steer Clear of High-Pressure Sales Techniques

Take your time to evaluate opportunities, even if you’re told they are limited.

6.Protect Personal Information

Don’t share private information such as bank account numbers, PANs, or Aadhaar with unverified sources.

Beware of phishing scams asking for OTPs or login credentials.

7.Seek Independent Advice

Consult a licensed financial advisor before making significant investments.

8.Stay Updated

Follow alerts from SEBI, RBI, or global regulatory bodies about recent scams.

Enroll in financial literacy programs offered by credible organizations.

What to Do If You’re a Victim of an Investment Scam

In order to reduce your losses and begin the healing process, you must move fast if you believe you have been the victim of an investment fraud. In both international and Indian situations, you should perform the following:

Actions to Take Right Away

1.Gather Proof :Keep track of all correspondence, such as texts, emails, contracts, receipts, and transaction logs.

Keep a record of all information pertaining to the scam, including names, phone numbers, and websites.

2.Inform the Authorities of the Scam

For Global Victims:

1.File a complaint with the U.S. Securities and Exchange Commission (SEC): https://www.sec.gov.

2.Report to the Federal Trade Commission (FTC) for consumer protection assistance: https://www.ftc.gov.

3.Use FINRA BrokerCheck to verify if the broker or financial advisor is legitimate: https://brokercheck.finra.org.

For Indian Victims:

1.Report the fraud to the SEBI SCORES Platform: https://www.scores.gov.in.

2.This platform allows you to register complaints about investment products or advisors.

3.Contact the Reserve Bank of India (RBI) for scams involving unauthorized financial entities: https://www.rbi.org.in.

4.Verify the company’s registration through the Ministry of Corporate Affairs (MCA): https://www.mca.gov.in.

3.Notify Your Bank or Financial Institution

1.If you transferred money to the scammer, contact your bank immediately to request a reversal or chargeback for unauthorized transactions.

2.Freeze your accounts if you suspect sensitive information, such as bank details, has been compromised.

4.File a Cybercrime Complaint

1.You can report internet scams in India using the National Cyber Crime Reporting Portal: https://cybercrime.gov.in.

2.For global users, contact local law enforcement or cybercrime units for further assistance.

Long-Term Recovery Steps

1.Monitor Your Financial Accounts

Keep a close watch on your bank statements and credit reports to spot any unauthorized transactions.

2.Seek Legal Advice

1.Consult a lawyer to explore options for recovering funds, especially if large sums are involved.

2.Legal representation may be necessary for filing claims or joining class-action lawsuits against the fraudster.

3.Stay Updated on Scam Alerts

Follow updates from financial regulatory authorities to stay informed about recent scams.

India: Visit SEBI’s investor education section: https://www.sebi.gov.in.

Global: Use Investor.gov for resources and scam prevention tips: https://www.investor.gov.

Remember

Reporting the scam not only helps you but also prevents others from becoming victims. Leverage the resources provided by trusted regulatory bodies like SEBI, SEC, RBI, and FTC to fight back against fraud.

Learning from Real-Life Cases

Global Cases

Bernie Madoff: Highlighted the importance of verifying returns and conducting due diligence.

FTX Collapse: Showed the risks of investing in unregulated digital assets.

Indian Cases

Saradha Chit Fund Scam: Affected 1.7 million investors, emphasizing the need for SEBI regulation.

GainBitcoin Fraud: Demonstrated the dangers of investing in unverified cryptocurrencies.

Key Takeaways

Avoid schemes promising guaranteed or unrealistic returns.

Always use regulated platforms and seek professional advice.

Final Thoughts

Although local and international investment frauds are becoming more common, you can protect your money by being aware and alert. The first step is to identify warning indications, such as unregistered salespeople, high-pressure methods, and unrealistic returns. Never give personal information to unreliable sources, always do extensive research on investment options, and confirm advice with regulatory bodies like the SEC or SEBI.

Take prompt action by gathering evidence, reporting the scam to the police, and alerting your bank if you become a victim. To protect yourself and others, use sites such as Investor.gov worldwide or SEBI SCORES in India.

Education is the first step toward financial safety. Keep up with updates from reliable sources such as the FTC, RBI, and SEBI. In order to raise awareness and stop additional fraud, share this information with your loved ones. By remaining watchful and relying on regulated platforms, you can confidently navigate the investment landscape and build a secure financial future.

FAQs

1.What are the most common investment scams?

Ponzi schemes, pyramid schemes, cryptocurrency fraud, and advance fee scams are prevalent worldwide.

2.How do I verify a company’s legitimacy?

Use platforms like SEBI (India) or SEC (U.S.) to check the registration and credentials of the company or advisor.

3.Can I recover my money if I’m scammed?

While recovery isn’t guaranteed, reporting the scam early to authorities and working with banks increases your chances.

4.Is it safe to invest via social media?

No, avoid investments promoted through unverified social media accounts or influencers.

5.How do scammers use social media for fraud?

Scammers create fake profiles, promote fraudulent schemes, and share phishing links to dupe users.

6.What should I do if I suspect an investment is a scam?

Stop communication, collect evidence, and report the scam to regulatory bodies like SEBI or FTC.

7.How can I protect my personal information online?

Avoid sharing sensitive details like Aadhaar, PAN, or OTPs on unverified platforms or via email.