Are you feeling overwhelmed by debt? You’re not alone. Millions worldwide struggle with credit card bills, personal loans, and unexpected expenses. But here’s the good news—smart debt management can transform your financial future. Studies from the OECD and World Bank reveal that effective debt management strategies can boost financial stability and reduce stress.In this post, we break down 10 vital Actionable debt management tips to help you regain control. From setting realistic budgets and negotiating lower interest rates to tackling credit card debt efficiently, you’ll find actionable steps designed for beginners. Plus, we’ve included real-life case studies,comparison tables, downloadable checklists, and trusted educational resources–everything you need to take charge of your personal finances and build a secure future.

“No matter where you are in the world, taking charge of your debt today paves the way to a brighter financial future.”

Understanding Debt: What Is Debt and Why Is It Important to Manage It?

Before diving into vital actionable debt management tips, it’s essential to understand what debt means in a global context.

What Is Debt?

Debt is money borrowed from others, which must be paid back over time, usually with interest. It can take many forms, including:

Loans: For education, housing, or personal needs.

Credit Cards: Revolving balances that can accumulate interest.

Other Financial Obligations: Such as car loans, medical bills, or business financing.

Good Debt vs. Bad Debt

Not all debt is harmful.

Understanding the difference can help you use debt wisely:

Good Debt:

Investments: Borrowing money for education or a home can improve your future prospects.

Business Loans: Funds that help grow a business and generate income.

Bad Debt:

High-Interest Borrowing: Such as credit card balances that accumulate interest quickly.

Consumer Debt: Loans for non-essential items that lose value over time.

Tip:

“Debt, when managed wisely, can be a tool for growth. However, uncontrolled debt can lead to financial stress.”

10 Vital Actionable Debt Management Tips

1. Assess Your Financial Situation 💶

Before planning your repayment strategy, take a clear look at your current financial status.

How to Assess Your Financial Situation

Inventory Your Debts: List every debt you owe. Include the type of debt, amount, interest rate, and repayment terms.

Calculate Your Debt-to-Income Ratio: Divide your monthly debt payments by your gross monthly income. This ratio helps you understand how much of your income is going toward debt.

The Ideal Debt-to-Income (DTI) ratio is 35% or lower, meaning no more than 35% of your income goes toward debt payments. A DTI below 20% is considered excellent, while anything above 40% may signal financial risk.

Debt Calculators:

Use interactive debt repayment calculators from global resources like the World Bank or trusted websites like Investopedia.

(Tip: A lower ratio generally indicates a healthier financial situation.)

Review Your Credit Score:

Check your credit score using global tools. Many regions have credit agencies (like Experian, Equifax, or local equivalents) that provide free credit reports.

Quick Checklist:

List of all debts

Debt-to-income ratio calculation

Current credit score

Download Free Finance Debt Management Checklist Template from Template.net using the link below:

Free Finance Debt Management Checklist Template

2. Create a Realistic Budget 📝

A well-planned budget is the foundation of successful debt management.

Steps to Create a Budget

Track Income and Expenses: Record every source of income and every expense—even small purchases count.

Identify Areas to Cut Spending:

Analyse your spending to find non-essential expenses you can reduce.

Set Spending Limits: Allocate funds for necessities, savings, and debt repayment. Adjust your budget monthly based on changes in your income or expenses.

Recommended Budgeting Tools

Budgeting Apps: Budgeting Apps like EveryDollar or YNAB work globally for tracking expenses.

Spreadsheets: Create a custom spreadsheet if you prefer a tailored approach.

101 Planners’ Budget Sheet Template

https://www.101planners.com/budget-sheet-template/

Tip:

“Revisit your budget regularly — it’s a living document that grows with your financial journey”

Explore our posts on “Create your Personal Budget: Practical Tips for Success” to learn more about visiting

3. Prioritize Your Debts 💰

Not all debts should be repaid at the same pace. Prioritizing can help you reduce interest payments and stay motivated.

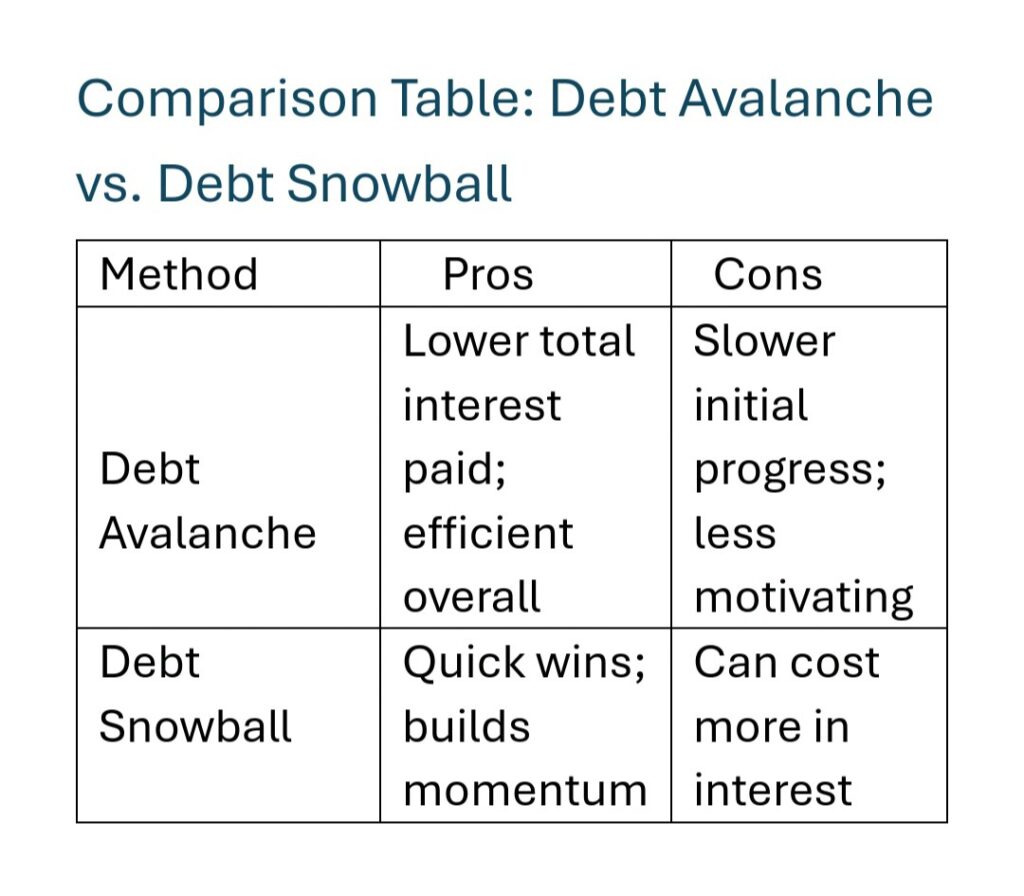

Debt Repayment Methods

Two popular methods are:

Debt Avalanche Method:

Focus on paying off debts with the highest interest rates first.

Pros: Saves money on interest over time.

Cons: It may take longer to see small wins.

Debt Snowball Method:

Focus on paying off the smallest debts first to gain momentum.

Pros: Provides quick wins that boost confidence.

Cons: Might result in paying more interest overall.

Debt Management Tool 📱

Try a Debt Repayment Calculator to determine which method suits your needs best.

4. Negotiate Lower Interest Rates 🪙

Reducing your interest rates can significantly lessen your debt burden, especially for high-interest loans and credit cards.

Steps to Negotiate Lower Interest Rates

Review Your Credit Report: Identify any errors and understand your credit standing.

Prepare Your Case: Gather information on competitive interest rates and highlight your positive payment history.

Contact Your Lender: Politely request a lower rate. Many lenders, including those operating globally, are willing to negotiate if you demonstrate financial responsibility.

Managing Credit Card Debt Effectively

Credit card debt can be particularly challenging due to high interest rates. Here are some strategies:

Balance Transfers: Transfer your balance to a card with a lower or 0% introductory rate.

Automatic Payments: Set up regular payments to avoid late fees and higher interest rates.

Pay More Than the Minimum: Even a slight increase in your monthly payment can significantly reduce the interest over time.

Case Study:

A young professional in Europe managed to reduce her credit card interest rate by 2% after a polite negotiation. By increasing her monthly payments, she cut her overall repayment time by nearly half a year.

Video Resource:

Watch this short video on Negotiating Lower Interest Rates for practical & actionable tips (video accessible globally).

5. Consider Debt Consolidation✊

Combining multiple debts into a single, manageable payment can simplify your finances.

What Is Debt Consolidation?

Definition: Debt consolidation means taking out one loan to pay off several debts, often at a lower overall interest rate.

Pros:

One easy-to-manage monthly payment.

Potentially lower interest rates.

Cons:

May extend the repayment period if not carefully managed.

Requires careful reading of terms and conditions.

Case Study

An entrepreneur in Asia consolidated several high-interest loans into one loan with a lower rate, reducing his monthly payments and improving cash flow.

Tip:

“Always compare consolidation offers from multiple providers to ensure you’re getting the best deal available in your region.”

6. Avoid Accumulating New Debt ❌

The key to long-term financial health is preventing new debt while repaying old debts.

How to Avoid New Debt

Practice Responsible Credit Use:

Avoid impulse purchases and use credit only for necessary expenses.

Use Cash or Debit: Pay with cash or debit cards to limit overspending.

Build a Savings Buffer: Save for unexpected costs rather than relying on credit.

Quick Tips in Bullet Points:

Plan your purchases ahead of time.

Regularly monitor your bank statements.

Focus on saving for emergencies.

7. Build an Emergency Fund 💶

An emergency fund protects you from unexpected expenses, preventing you from falling into new debt.

Steps to Build an Emergency Fund

Start Small: Aim for an initial fund of around $500 (or the equivalent in your currency), then gradually increase it.

Automate Your Savings: Set up regular transfers to a dedicated savings account.

Review and Adjust: As your income grows, revisit your savings goal.

Tip:

“Even a small emergency fund can offer peace of mind and safeguard you from unexpected financial shocks.”

To learn more about money saving tips read our posts on “Essential 20 Quick Money Saving Tips for Beginners”

8. Seek Professional Advice 🧑💼

Sometimes the best way to navigate complex debt issues is to seek expert help.

When to Seek Professional Help

Financial counselors: Certified financial advisors or counselors can offer personalized advice.

Credit Counseling Services: Many countries have non-profit organizations that offer free or low-cost credit counseling. For example, organizations in Europe, Asia, and Africa provide similar services as those in the United States.

National Foundation for Credit Counseling (NFCC) – Global Debt Help

Link: NFCC

Online Resources: Use trusted websites like Investopedia to access financial tools and advice.

Recommended Global Resources

Consumer Protection Agencies:

Check with your local consumer protection agency for advice on managing debt.

International Financial Organizations: Resources from the OECD and the World Bank offer insights into global debt trends and financial management.

Educational Websites: Websites like Investopedia and NerdWallet provide clear, accessible financial education.

Tip:

“Seeking help is a sign of strength. Don’t hesitate to reach out to professionals when needed.”

9. Stay Motivated and Monitor Your Progress 🗓️

Keeping track of your progress is vital for long-term success in debt management.

Ways to Monitor Your Progress

Set Short-Term Goals: Break your repayment plan into smaller, achievable milestones.

Use Apps and Spreadsheets: Free Financial tools like RocketMoney can help you track every payment and see your progress over time.

Celebrate Achievements: Recognize your milestones—small celebrations can keep you motivated on your journey to financial freedom.

Tools: Consider using an online Debt Tracker to visualize your progress and set reminders for repayments.

10. Educate Yourself on Personal Finance 📚

Educating yourself about personal finance and improving your financial literacy is a lifelong journey that can help you adapt to changing financial circumstances.

How to Boost Your Financial Knowledge

1.Read Books:

Look for beginner-friendly books such as “The Total Money Makeover” by Dave Ramsey or “Your Money or Your Life” by Vicki Robin.

2.Online Courses:

Platforms like Coursera, Khan Academy, and edX offer free courses in personal finance and money management.

3. Watch Educational Videos:

Explore YouTube channels dedicated to personal finance, which offer practical tips in simple language.

How to Manage Credit Card Debt Effectively

Global Debt Management Strategies Explained

Tip:

“Continuous learning is key to financial success. Stay curious, stay informed, and adjust your strategies as needed.”

Global resources to learn more about debt management

Here are some global resources to help you learn more about debt management, including budgeting, debt repayment strategies, and financial planning:

1. OECD – Financial Literacy & Consumer Protection

Resource: Guides on financial education and debt management strategies.

Link: OECD Financial Education

2. World Bank – Financial Inclusion & Debt Management

Resource: Research and tools for responsible debt management worldwide.

Link: World Bank Financial Inclusion

3. International Monetary Fund (IMF) – Financial Stability & Debt Advice

Resource: Global insights on personal and public debt management.

Link: IMF Financial Stability

4. Money Advice Service (UK) – Free Debt Management Guides

Resource: Step-by-step debt repayment plans and budgeting tools.

Link: MoneyHelper UK

5. U.S. Consumer Financial Protection Bureau (CFPB) – Debt Tools & Advice

Resource: Practical tips on managing credit card debt and loans.

Link: CFPB Debt Management

6. Australian Government’s Moneysmart – Debt Reduction Strategies

Resource: Government-backed advice on reducing and managing debt.

Link: Moneysmart Australia

Final Thoughts

Taking control of your debt is a journey that requires understanding, planning, and continuous effort. By assessing your financial situation, creating a realistic budget, prioritizing debts, and exploring options such as negotiating lower interest rates or consolidating your debt, you’re on your way to a more secure financial future. Remember to avoid new debt, build an emergency fund, and seek professional advice when needed. Lastly, continuous education and monitoring of your progress are key to staying motivated.

No matter where you live, these 10 vital Actionable Debt Management Tips are designed to be practical and adaptable to your unique financial circumstances. Start today, use our free resources and checklists, and take one step at a time towards financial freedom.

Final Call-Out:

“Empower yourself with knowledge and discipline — financial freedom is within reach for everyone, everywhere.”

FAQs

1.What is debt and why is it important to manage it?

Debt is money borrowed from lenders that must be repaid over time. Effective debt management is crucial for financial stability and reducing long-term stress.

2.What is the difference between good debt and bad debt?

Good debt is used for investments like education or a home, which can build wealth. Bad debt includes high-interest or non-essential loans that may harm your financial health.

3.How do I start managing my debt effectively?

Begin by assessing your financial situation, listing all debts, calculating your debt-to-income ratio, and then creating a realistic budget to guide your repayments.

4.What tools can help me track my debt and expenses?

Budgeting apps like PocketGuard or YNAB, custom spreadsheets, and online debt calculators can help you monitor income, expenses, and progress toward debt reduction.

5.How can I reduce my credit card debt?

Consider strategies such as balance transfers, negotiating lower interest rates, setting up automatic payments, and paying more than the minimum monthly amount.

6.What is debt consolidation and when should I consider it?

Debt consolidation combines multiple debts into a single loan—often with a lower interest rate—making repayment easier. It is especially useful when managing several high-interest loans.

7.Where can I find free, reliable educational resources on personal finance?

Explore global resources from organizations like the OECD, World Bank, Investopedia, and your local consumer protection agency.